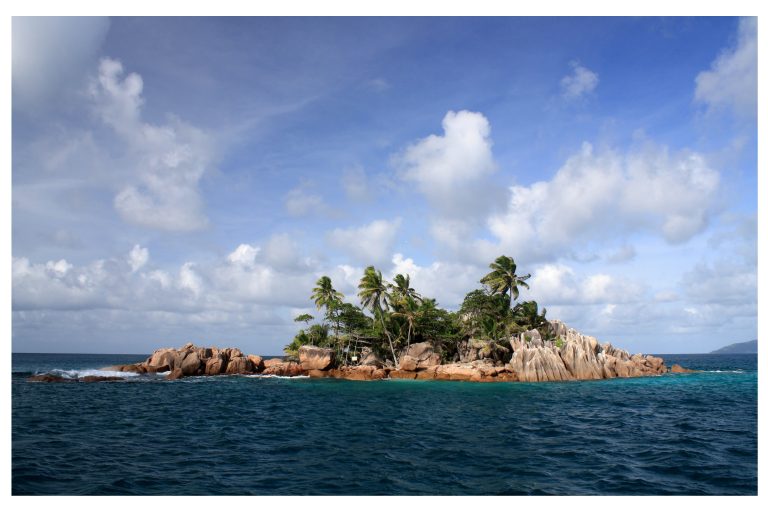

At today’s meeting of EU Economic and Finance Ministers (ECOFIN), a decision was made on the EU list of tax havens. Despite the biggest tax leak ever, the PandoraPapers, the list was shortened. The Caribbean islands of Anguilla and Dominica as well as Seychelles were removed from the list. Now there are only nine countries on the EU list of tax havens: American Samoa, Fiji, Guam, Palau, Panama, Samoa, Trinidad and Tobago, U.S. Virgin Islands, and Vanuatu. The Greens/EFA Group successfully secured a plenary debate in the European Parliament on the Pandora Papers on Wednesday (6 October, 3 pm). Also on Wednesday (6 October), MEPs will vote on a report on the exchange of information in tax matters.

MEP Sven Giegold, financial and economic policy spokesperson of the Greens/EFA group commented:

“The reaction of EU finance ministers to the PandoraPapers borders on denial of reality. While tax havens continue to flourish, EU finance ministers are slashing their list of tax havens. Instead of showing a firm reaction to the PandoraPapers, the EU finance ministers’ meeting is a topsy-turvy world. Important tax havens are missing from this EU list anyway, and now the list is getting even shorter. The PandoraPapers show that billionaires and powerful people use many tax havens that are not on the EU list. Two-thirds of the shell companies in the Pandora data are in the British Virgin Islands, which are missing from the EU tax haven list. The EU list of tax havens is hardly any good in the fight against global tax fraud.

After the PandoraPapers, EU tax policy needs a wake-up call. We need hard criteria for the global exchange of information between tax authorities and more transparency. The list of tax havens must be fundamentally revised. We have long been calling for stricter criteria, an independent decision-making process, and transparency about the actual owners of letterbox companies and real estate. The PandoraPapers show that information on beneficial owners is central to uncovering extensive ownership. We also demand publicly accessible registers of beneficial owners from third countries and improvements in the criteria for asset verification and fair taxation. The EU can only make credible progress here if it also applies these criteria to intra-European tax havens.

Improved international exchange and more transparency on ownership can curb tax avoidance and money laundering. Tax avoidance exacerbates global injustice. After the latest revelations, there must be a strong signal from Europe against the global tax avoidance crisis.”

—

Council press release: https://www.consilium.europa.eu/de/press/press-releases/2021/10/05/taxation-anguilla-dominica-and-seychelles-removed-from-the-eu-list-of-non-cooperative-jurisdictions/