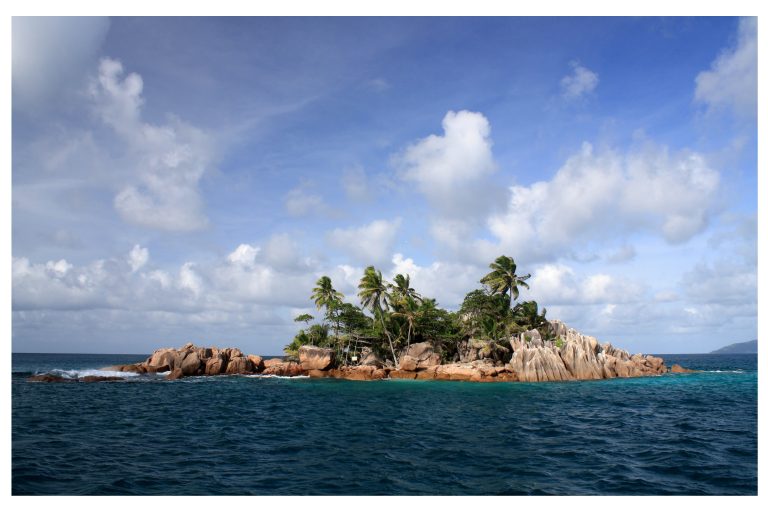

Tomorrow, 5 October, the decision on the new EU list of tax havens will be on the agenda of the meeting of the economy and finance ministers of the 27 EU member states. It has already become known that the list will be shortened: Anguila, the Seychelles and Dominica are to be removed from the list. This leaves nine countries on the EU list of tax havens: American Samoa, Fiji, Guam, Palau, Panama, Samoa, Trinidad and Tobago, U.S. Virgin Islands and Vanuatu.

MEP Sven Giegold, financial and economic policy spokesperson of the Greens/EFA group commented:

“The PandoraPapers must be a wake-up call for EU finance ministers. Unfortunately, a grotesque picture is emerging at the meeting of EU finance ministers: while journalists publish the biggest tax leak ever, EU finance ministers are weakening their list of tax havens. In view of flourishing tax havens, it is absurd that the finance ministers are shortening the tax haven list. The EU list of tax havens is hardly any good in the fight against tax evasion. The list is piecemeal, with a number of important tax havens missing. The PandoraPapers show that billionaires and powerful people use many tax havens that are not on the EU list. Two-thirds of the shell companies in the Pandora files are in the British Virgin Islands, which are missing from the EU tax haven list.

The EU list of tax havens must be fundamentally revised. The European Parliament has long been calling for stricter criteria and an independent, transparent decision-making process. In January, the European Parliament had demanded that the EU list of tax havens include a hard criterion on the transparency of beneficial owners. EU finance ministers have blocked the introduction of this criterion since the beginning of the tax haven list in 2017. The PandoraPapers have shown how important this information about the real owners of a letterbox company is. Third countries should therefore have to keep publicly accessible registers of the beneficial owners of companies, as is already mandated by law within the EU. The criteria for third countries, also with regard to economic substance and fair taxation, must be strengthened. The EU can only make credible progress here if it also applies these criteria to intra-European tax havens.

We now need stricter criteria for the global exchange of information between tax authorities and more transparency overall. There is still a lack of transparency about the real owners of letterbox companies and real estate. Improved international exchange of tax information and more transparency on ownership can curb tax avoidance and money laundering. After the Pandora Papers, there must be a strong signal from Europe against the global tax avoidance crisis. Tax avoidance exacerbates global injustice. We have secured a debate at the European Parliament’s plenary session on the new tax leak.”

Background:

The EU list of tax havens was introduced in 2017 with the aim of putting an end to tax havens around the world and imposing sanctions on them to stop the loss of tax revenues. Currently, it covers only about 2 per cent of corporate tax avoidance worldwide. Most recently, the European Parliament had called for stricter criteria for the list as well as a consistent and transparent listing process.

The EU list of tax havens is the result of a review and dialogue process of the Code of Conduct Group on Business Taxation in the European Council with third countries. In this process, EU member states assess third countries according to criteria on tax transparency, fair taxation, implementation of OECD BEPS measures and examination of the economic substance of tax arrangements for zero-tax countries. Unfortunately, these criteria are not always applied consistently. Member states, such as Malta, which do not meet the criteria for third countries are unfortunately not sanctioned. The criteria also need to be tightened in order for them to cover all tax havens. Furthermore, the Parliament demands that the criteria also be used to clearly identify tax havens in the EU.

A detailed elaboration of the demands of the European Parliament can be found here: https://sven-giegold.de/en/landmark-decision-eu-list-tax-havens/

—

Turkey will remain on the so-called “grey list” and will not be added to the list of tax havens as required by the criteria. The country still does not share tax-relevant data with Cyprus. Currently, only two member states are able to interpret tax data from Turkey; for most, it is unreadable. Nevertheless, member states are expected to make an exception for Turkey for the third time.