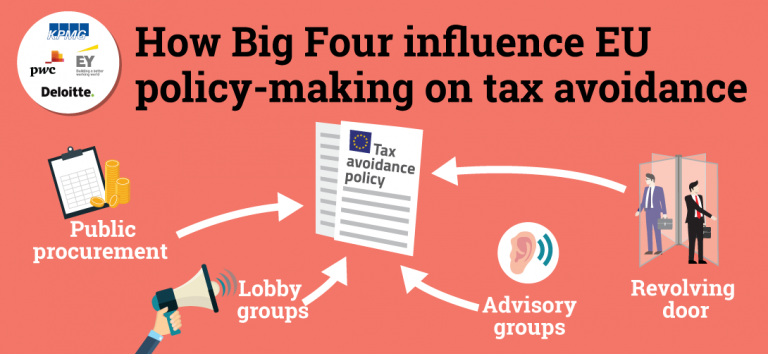

Corporate Europe Observatory just released a study detailing how the “Big Four” accounting firms, Deloitte, EY, KPMG and PWC influence EU tax policies despite their obvious conflicts of interest as designers and providers of tax avoidance schemes to multinational corporations. Despite all revelations of their assistance in tax avoidance since the Luxembourg Leaks, the Big Four increased their public procurement contracts advising the EU Commission from 7 million euro in 2014 to 10.5 million in 2018. The Big Four dominate advisory groups convened by the EU Commission, often under the cover of front organisations hiding their names and intentions behind broader labels such as the American Chamber of Commerce. The study lists 12 EU policy makers in key roles on EU tax policy in the EU Commission and the permanent representations of Member States who took the revolving door to or from the Big Four (see page 20).

The influence is proven for the 2 cases of the Commission proposals for new transparency rules for tax advisers to report aggressive tax avoidance schemes and for public country-by-country reporting of multinationals on their profits and taxes. While Commission had proposed to oblige tax advisers to report aggressive tax avoidance schemes to public authorities, KPMG and Deloitte pushed for a voluntary approach. The notoriously intransparent Council adopted amendments resembling PWC advice from earlier stages of the process. PWC had proposed limitations to avoid to “disproportionately burden” multinationals, more narrow criteria for what accounts as “aggressive” in schemes and requiring an unanimous vote to ban tax schemes. Council’s final text of March 2018 included all those PWC proposals proving the revolving door between permanent representations and the Big Four as effective. On public country-by-country reporting, EY proposed limitations for “commercially sensitive information”. After intense lobbying, already Parliament adopted a get-out clause that allows multinational corporations to keep “commercially sensitive” data secret.

MEP Sven Giegold, financial and economic policy spokesperson of the Greens/EFA group and the European Parliament’s rapporteur on transparency, accountability and integrity in the EU institutions commented:

“The massive influence of the Big Four designers of tax avoidance schemes on EU institutions’ efforts to arrive at tax justice stinks to high heaven. Paying and courting the fox to keep the geese has to stop! We need EU institutions with integrity to win tax justice. The EU Commission has to stop giving EU funding to the tax avoidance experts for advice on tax justice and employ sufficient independent expertise. The revolving door for tax avoidance experts to the EU Commission and Member State representations has to be closed. Permanent representations of EU governments have to publish their lobby meetings so that citizens can know whose interests are taken into account. The Council’s lack of lobby transparency proves to be expensive for citizens and small business who have to pay more taxes if multinationals pay less or nothing.

European governments must end blocking tax transparency for multinational companies in the Council and adopt mandatory country-by-country reporting requirements as recommended by the European Parliament.“

The study by Corporate Europe Observatory: https://corporateeurope.org/power-lobbies/2018/07/accounting-influence