Today, EU finance ministers removed several third countries from the EU list of non-cooperative countries in tax matters. The US are still not on the EU list of tax havens. Since June 2019, countries that have not signed the OECD (Organisation for Economic Cooperation and Development) agreement on automatic exchange of information must be blacklisted. However, the EU member states’ Council Working Group on the Code of Conduct for Business Taxation found the bilateral agreements between the US and the European Member States to be equivalent to the OECD agreement. Only the EU Member States are responsible for this working group, not the EU Commission.

Switzerland, Albania, Costa Rica, Serbia and Mauritius will be removed from the grey list of countries under scrutiny. Experts from the Member States had analysed the tax laws of these countries and considered them sufficient. The Marshall Islands and the United Arab Emirates are removed from the blacklist and placed on the grey list. Both countries had made political commitments to meet EU criteria on tax transparency, fair taxation and implementation of OECD measures by the end of 2020. This leaves nine countries on the blacklist: American Samoa, Belize, Fiji, Guam, Oman, Samoa, Trinidad and Tobago, US Virgin Islands and Vanuatu.

MEP Sven Giegold, financial and economic policy spokesperson of the Greens/EFA group commented:

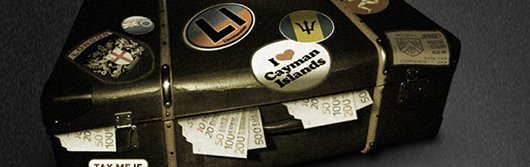

„The blacklist loses credibility if the EU applies double standards. The EU must treat the US just like any other country. Anyone who behaves like a tax haven should be on the list. The European finance ministers do not consistently apply their own tax haven criteria. Because the US does not participate in the OECD exchange of information, US letterbox companies remain opaque to European tax authorities. The US do not provide the type of information it receives from Europe. The US are inviting for tax evasion through anonymous letterbox companies.

The blacklist has pushed tax havens around the world to change or abolish their most harmful tax laws. That shows: If the EU works together, it can do something against global tax avoidance.

The criteria of the Code of Conduct Group for business taxation are still too weak to consistently combat tax dumping. It is absurd that Switzerland is removed from the grey list. In Switzerland, tax dumping by companies continues unabated. The latest corporate tax reform has lowered tax rates in many cantons and created new tax avoidance schemes such as broad-based patent boxes. However, Switzerland now meets the European minimum requirements. Unfortunately, zero or near zero taxation of profits is permitted under EU law, and even an assessment of the economic substance of tax arrangements is not mandatory. The EU must therefore revise its own rules and in particular tighten the criterion of the harmfulness of tax practices“.

Proposal for the decision by EU finance ministers: https://data.consilium.europa.eu/doc/document/ST-12284-2019-REV-1/en/pdf