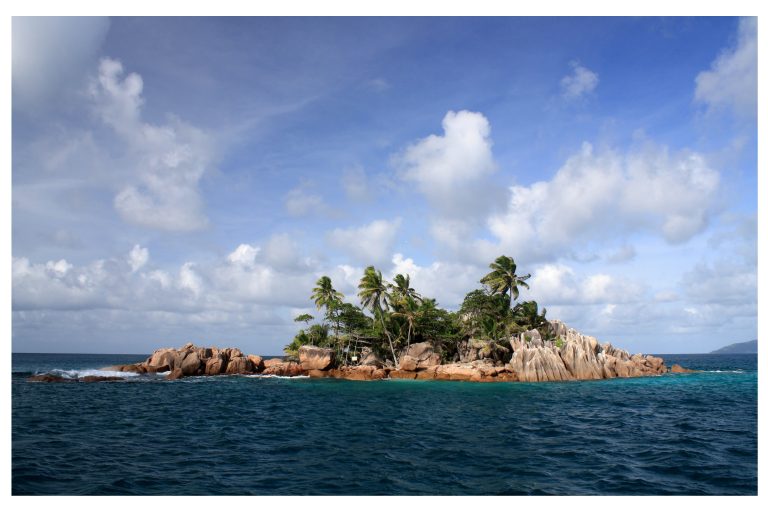

Today (Tuesday, 18 February), the European Union’s Ministers of Economy and Finance presented the updated list of tax havens, to include also Panama, the Seychelles, the Cayman Islands and Palau, because they do not meet at least one of the European Union’s tax good governance criteria: tax transparency, fair taxation and real economic activity.

Sven Giegold, financial and economic policy spokesman for the Greens/EFA group in the European Parliament, comments:

„The blacklist is a step forward in the fight against tax evasion. It is logical that the ministers of economics and finance are listing well-known tax havens for the first time. But the list has gaps: European governments lack the guts to put the USA and Turkey on the list. They have not dared to take this step out of consideration for political sensitivities. The USA in particular is inviting tax evasion via anonymous letterbox companies and depots. The politicisation of the blacklist is the wrong signal. Third countries must not be measured with double standards. To preserve European credibility, EU countries should also be judged according to the criteria for EU tax havens.”

So far eight territories have been blacklisted:

American Samoa, American Virgin Islands, Fiji, Guam, Oman, Samoa, Trinidad and Tobago, and Vanuatu. New additions include: Panama, the Seychelles, the Cayman Islands and Palau