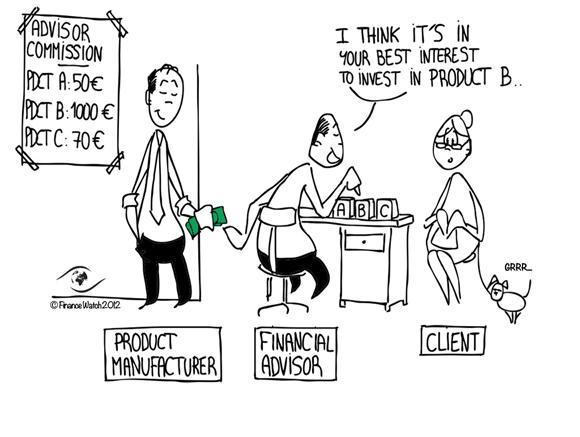

Die Vertreter der europäischen Bankenverbände haben heute diesen Brief an die Berichterstatter der Fraktionen im Europaparlament zur MiFID-Richtlinie sowie an alle Abgeordneten der sozialdemokratischen S&D-Fraktion geschickt, in dem sie sich gegen Provisionsverbote in der Finanzberatung aussprechen. Passend dazu dieser Cartoon von FinanceWatch zur provisionsgetriebenen Finanzberatung:

Update 23.10.: Europäische Verbaucherschützer halten dagegen: Ebenfalls am 22.10. hat der Europäische Verbaucherverband (BEUC) einen Brief an alle Abgeordneten geschickt, mit dem Appell, das Verbot von Provisionen zu untersützen.

Hier der Brief der Bankenverbände:

To: Members of the European Parliament

Brussels, 22 October 2012

RE: Banning of inducements in MiFID II

Dear Members of the European Parliament,

The European Banking Associations (EACB, EAPB, EBF & ESBG) would like to comment on the current discussions taking place ahead of the plenary vote on MiFID this week in Strasbourg.

We are aware that there have been renewed efforts to fully ban inducements when providing investment advice. Our associations[1] are against a complete ban of inducements, which is neither supported by the European Commission nor the Council[2], for the following reasons:

- A ban on financing investment advice through inducements has deep social implications, as it would disadvantage smaller investors who cannot afford anymore to take advice on how to invest and, for example, effectively provide for their retirement savings. A number of banks in the UK, which has unilaterally decided to ban inducements on investment advice from 2013 going forward, have already announced that investment advice will only be available for clients with more than £25.000 or £100.000 to invest[3].

- Conflicts of interests are not simply abolished under a complete ban. The conflict will either be shifted towards an incentive to increase the number of investment advices to clients or a situation in which a client who chooses an investment product in relation to the highest inducements to be received – in case the inducements are transferred to the client[4]. The existing compromise[5] has taken care of these issues – which are about properly managing these possible conflicts – in Article 23 and 24 and all-in-all proposes balanced measures.

We strongly believe that all investors should be able to have access to the best possible advice. The associations are convinced the present compromise – which limits the receipt of inducements to those that enhance the quality of the advice – finds the right balance between consumer choice and consumer protection. We are a firm supporter of the high level of transparency, as proposed under the compromise and believe that this will achieve the central objective of providing the most important high quality advice to all of our clients.

Given the above reasons, we encourage you during the vote in plenary to vote against amendment 2 and vote in favour of amendment 5 brought forward on behalf of the S&D, EPP and ALDE Group.

Yours sincerely,

European Association of Co-operative Banks (EACB)

Hervé GUIDER – General Manager

European Association of Public Banks (EAPB)

Henning SCHOPPMANN – Secretary General

European Banking Federation (EBF)

Guido RAVOET – Chief Executive

European Savings Bank Group (ESBG)

Chris DE NOOSE – Managing Director

European Association of Co-operative Banks (EACB)

The European Association of Co-operative Banks (EACB) is the voice of the co-operative banks in Europe. It represents, promotes and defends the common interests of its 28 member institutions and of co-operative banks in general. Co-operative banks form decentralised networks which are subject to banking as well as co-operative legislation. Democracy, transparency and proximity are the three key characteristics of the co-operative banks’ business model. With 4.200 locally operating banks and 63.000 outlets co-operative banks are widely represented throughout the enlarged European Union, playing a major role in the financial and economic system. They have a long tradition in serving 160 million customers, mainly consumers, retailers and communities. The co-operative banks in Europe represent 50 million members and 750.000 employees and have a total average market share of about 20%.

European Association of Public Banks (EAPB)

The European Association of Public Banks (EAPB) represents the interests of 40 public banks, funding agencies and associations of public banks throughout Europe, which together represent some 100 public financial institutions. The latter have a combined balance sheet total of about EUR 3,500 billion and represent about 190,000 employees, i.e. covering a European market share of approximately 15%.

European Banking Federation (EBF)

Launched in 1960, the European Banking Federation (EBF) is the voice of the European banking sector from the European Union and European Free Trade Association countries. The EBF represents the interests of almost 5000 banks, large and small, wholesale and retail, local and cross-border financial institutions. Together, these banks account for over 80% of the total assets and deposits and some 80% of all bank loans in the EU only.

European Savings Bank Group (ESBG)

The European Savings Banks Group (ESBG) is an international banking association that represents one of the largest European retail banking networks, comprising about one third of the retail banking market in Europe, with total assets of over € 7.400 billion, non-bank deposits of € 3.300 billion and non-bank loans of € 4.000 billion (all figures on 31 December 2011). It represents the interests of its members vis-à-vis the EU Institutions and generates, facilitates and manages high quality cross-border banking projects. ESBG members are typically savings and retail banks or associations thereof. They are often organised in decentralised networks and offer their services throughout their region. ESBG member banks have reinvested responsibly in their region for many decades and are a distinct benchmark for corporate social responsibility activities throughout Europe and the world.

[1] Our associations are aware that some Member States have decided to introduce investment service on a national level paid only through fees. Neither our associations nor any of its members in those Member States challenges these national decisions nor their efforts to make these measures legally binding for all investment firms offering or providing investment services in that member state. However, the European banking associations want to underline the importance of choice for investment services on a pan-European level.

[2] See latest Cypriot compromise dated 09 October 2012 (link)

[3] Independent.co.uk Article dated 30 September 2012; link: http://www.independent.co.uk/money/banks-axe-investment-advice-for-small-savers-8190834.html

[4] Such a scenario to receive inducements while forwarding them to the client is envisaged under the current draft report under Article 24 (1c) (a), which can be found here: http://www.europarl.europa.eu/sides/getDoc.do?type=REPORT&reference=A7-2012-0306&language=EN

[5] We refer to the ECON Report as voted on 26 September and the subsequent compromise amendment 5 brought forward on behalf of the S&D, EPP and ALDE Group.

Hier der Brief der Verbraucherschützer:

BEUC – The European Consumer Organisation

Ref.: L2012_359/MGO/sc 22 October 2012

Dear Member of the European Parliament,

The review of the Markets in Financial Instruments Directive (MiFID) will be voted on in plenary session this Friday October 26th.

We strongly encourage you to support the amendment proposed by Arlene McCarthy MEP which calls for an EU-wide ban on commissions and inducements for financial advisors (not only for independent advisors).

Such a ban would improve the quality of investment products and advice which are of key importance for consumers in Europe.

For example, for the millions of consumers needing to buy a house, children wishing to pursue tertiary level education, the growing European pensioner population all in combination with the fiscal challenges in many Member States, make prudent personal savings and investments imperative.

And so commissions and inducements paid to financial advisors by product providers can lead to misdirected investments by consumers as the advice can be biased by the commission on offer to advisors.

Contrary to the claims of ban opponents, such a measure will not lead to more expensive investment products for consumers – what is often conveniently omitted is that retail investors are already unknowingly paying for advice via charges and annual commissions on products. On top of this, they cannot be sure who the actual product is good for, them or the advisor. Investments are sometimes recommended even in instances where the consumer should first be repaying credits debts or simply keeping a bank deposit.

In response to mis-selling which affected thousands of consumers, the UK is already introducing a ban on commissions and The Netherlands is acting similarly on all complex insurance and credit products. Finland already has banned commissions for retail insurances.

The consumer will not be left without information or advice. Generic advice (not personalised advice) will develop and this is of better value than a commission driven recommendation. We also refute industry claims that consumers will refrain from paying for advice. When consumers realise that making an investment will not cost more than today, that products carry fewer entry fees and costs and that they can rely on the received advice, the barrier to pay for advice falls.

We sincerely hope that you will consider our concerns and support this crucial amendment.

Yours sincerely,

Monique Goyens

Director General

NB: Please see annex for a more detailed answer to the question why consumers will be willing to pay for investment advice.