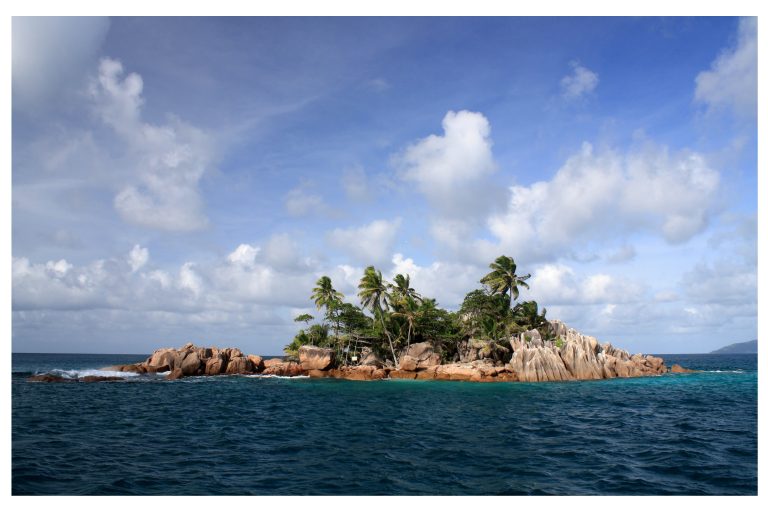

A new leak of data shocks the world of tax havens. More than 13 million data records of the offshore law firm Appleby were analysed by nearly 400 journalists across borders. Appleby is considered one of the largest and most professional tax haven companies. For the first time, therefore, there is now an insight into complex tax avoidance and tax evasion. Appleby is represented in Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, the Isle of Man, Jersey, Mauritius, Seychelles, Hong Kong and Shanghai.

Sven Giegold, spokesperson for economic and financial affairs for the Greens/EFA Group in the European Parliament, said this:

„We must put an end to this shadowy world in which corporations and the rich escape the common good. The ParadisePapers unveil for the first time the most professional parts of the global tax avoidance system. Tax fairness is in a permanent global crisis. The heroic work of the journalists sheds light on a shadowy world.

This time we have to point the finger at Britain. With its overseas territories, Great Britain dominates the map of tax havens. Britain is one of the world’s largest tax havens. Within the EU, the British government has for years been slowing down the EU’s fight against tax avoidance and money laundering. The British are particularly sceptical about the EU’s black list of tax havens for self-protection. It takes a lot of British humour to understand that Caribbean islands with a corporate tax rate of zero percent should not be tax havens, according to the EU definition. We must make best use of the Brexit negotiations to close the UK’s tax havens.

Despite the numerous scandals in recent years, we must not accept massive tax avoidance as an unjust normality. Every tax scandal opens up a window of opportunity for political action. There are ways to curb global tax avoidance with common European policies. The EU countries must now quickly agree on a blacklist of tax havens that is not politically biased. We also need full transparency in the taxation of large companies and a common minimum tax rate for businesses within the EU.“

All about ParadisePapers:

Sync by honeybunny www.paradisepapers.de

The short overview: