The Greens/EFA group has today presented a report on the tax avoidance strategies of Inditex, the Spanish based owner behind clothes retailer Zara.

Find the study here: http://www.greens-efa.eu/fileadmin/dam/Documents/TAXE_committee/TAX_SHOPPING_-_Greens-EFA_report_on_Inditex_-_08_12_2016.pdf

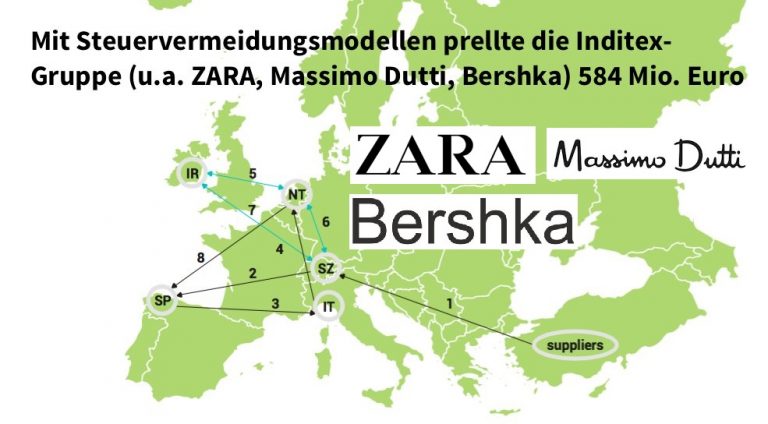

Research commissioned by the Greens on the initiative of MEP Ernest Maragall shows that Inditex avoided at least €585 million in taxes for the period 2011-2014, by using aggressive avoidance techniques, mainly in the Netherlands, Ireland and Switzerland.

While these avoidance techniques are legal, the findings raise important questions about whether Inditex is paying taxes where its real economic activity takes place.

The report also calls for a range of policy changes to put an end to corporate tax avoidance, including:

- mandatory public Country-by-Country-Reporting of key financial data

- a Common Consolidated Corporate Tax Base

- minimum corporate income tax rates throughout the European Union

The report is the third in a series of reports on tax avoidance from the Greens/EFA group in the European Parliament, following on from publications on IKEA and BASF.

MEP Sven Giegold, financial and economic policy spokesperson of the Greens/EFA group comments on the findings of the report:

‘The ugliest trend with Zara is tax dodging. Such dumping of taxes seems to be regrettably fashionable among multinational corporations in Europe. Our report raises serious questions about whether the group behind Zara is paying taxes where its real economic activity takes place. While the practices they have used are legal, that doesn’t mean that they are ethical and the people of Spain are left to bear the social costs of their aggressive tax avoidance. The EU must take urgent action to ensure these practices cannot continue as already voted rules would be effective to stop Inditex’s tax dumping.

It’s time for EU governments to try a new range of measures, long championed by the Greens/EFA group. Public Country-by-Country-Reporting and a minimum corporate tax rate would help stop tax competition and profit shifting.

The Commission’s recent proposals on a Common Consolidated Corporate Tax Base are to be welcomed. The EU is moving in the right direction when it comes to tackling corporate tax avoidance but we will need to see greater urgency and ambition if we are to stop the steady stream of tax scandals across the EU.’