The Greens in the European Parliament have recently released a study which aims to shed light on the subsidies and likewise the gains, which banks implicitly obtain due to the expectation that governments will rescue struggling credit institutions with tax payers money anyway. Creditors take this behaviour of the state into account and therefore lend capital to large banks for a lower interest rate, than to a credit institution, where the state would not step in. These so called “implicit subsidies” bring substantial gains to large banks.

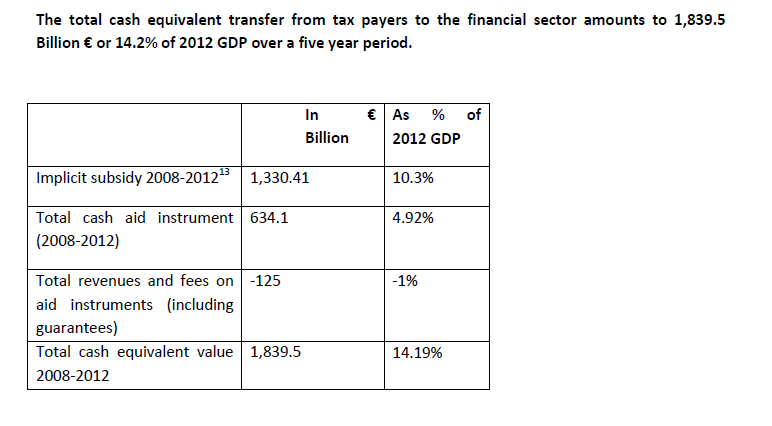

The facts and figures: The study reveals that between 2008 and 2012 banks which received these subsidies benefited from a financial advantage of approximately 1.330 trillion Euros.This amount is equivalent to 10.3% of European GDP of the year 2012.

These subsidies are called implicit – as opposed to explicit – because there is no contractual agreement specifying the amounts or conditions of government support. Currently, governments do not charge taxes or any contribution for these implicit subsidies. Implicit subsidies are a crucial policy concern, since they create significant distortions to markets, among others by providing a competitive advantage for big receiving banks in comparison to smaller banks without implicit subsidies. And they might come at a large expense for tax payers!

An important tool to tackle the problem of implicit subsidies is the structural reforms of banks, which is the key point of the Liikanen report. These reform proposals for the banking sector were elaborared by a group of experts and chaired by the Govenor of the Bank of Finland Erkki Liikanen. The experts were tasked to lay the ground for a legislative proposal by the European Commission. But the European Commission has drastically watered down Liikanen´s ideas. The measures proposed by the Commission risk having no effect on the banking sector apart from adding additional bureaucracy. It looks like a symbolic political act that allows Barnier to claim that he followed the Liikanen Group’s suggestions without effectively reducing the subsidies to large French or German banks such as Deutsche Bank.

Against this backdrop, our study aims at highlighting the need for real structural reforms in the banking industry.

Please find the study here (English version): bit.ly/1fhhFuU

Please find my analysis of the European Commission´s proposal for structural reforms in the banking sector here: http://bit.ly/1b0vAAQ

Please find the Liikanen report here: http://bit.ly/1aCsys9

We launched the study in parallel articles in leading European newspapers:

Süddeutsche Zeitung: http://bit.ly/1eaEHnd

Le Monde: http://bit.ly/1e2sCSt

El País: http://bit.ly/1jBdei7

Il Sole 24 Hore: http://bit.ly/1iDnC8K

New York Times: http://nyti.ms/1hExP10

Visao: http://bit.ly/1jXaLfD

De Standaard: http://bit.ly/1clSTtb

Het Financieele Dagblad: http://bit.ly/1esrliv

Overview on the key results of the study: (See p. 12 of the study)